Digital banking has become an essential part of everyday life, and Coyyn.com digital banking is at the forefront of this exciting transformation. With just a few clicks, you can manage your finances, pay bills, and transfer money securely from anywhere. No more waiting in long lines or rushing to the bank—now everything is right at your fingertips! Whether you’re at home, at work, or even on vacation, Coyyn.com makes it easy to stay on top of your finances.

In this article, we will explore how Coyyn.com digital banking is changing the way we handle our money. From setting up your account to discovering key features like mobile check deposits and instant money transfers, you’ll learn how to make the most of this innovative service. We’ll also share tips on keeping your digital banking experience safe, so you can enjoy peace of mind while managing your finances online. Get ready to take your financial management to the next level with Coyyn.com digital banking!

How to Set Up Your Coyyn.com Digital Banking Account: A Step-by-Step Guide

Setting up your Coyyn.com digital banking account is quick and simple. First, go to their website and select the type of account you want, like checking or savings. You’ll need to provide some basic personal information, such as your Social Security number and contact details. After filling out the form, you’ll need to verify your identity, often through a confirmation email or by uploading documents. Once your identity is verified, you can easily download the Coyyn.com mobile app, which is available on both Android and iOS devices. This app will allow you to access your account, check balances, and start managing your finances right away.

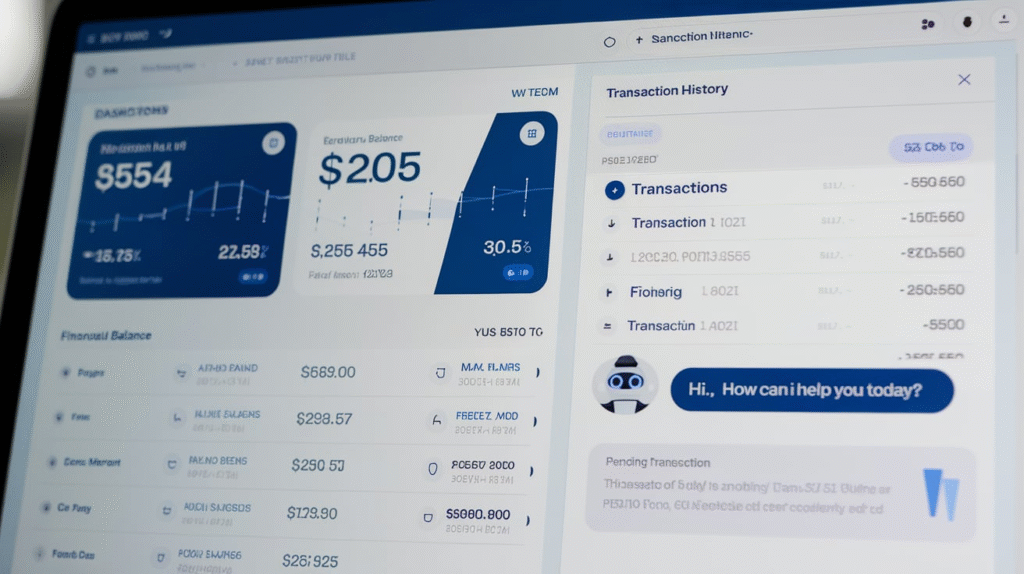

Key Features of Coyyn.com Digital Banking You Shouldn’t Miss

Coyyn.com digital banking comes with several important features to help you manage your finances. One standout feature is the mobile check deposit, which lets you deposit checks using your smartphone. This is especially helpful for those who can’t visit a bank in person. Another great feature is online bill pay, where you can set up one-time or recurring payments for bills directly through the app. Coyyn.com also supports quick and secure money transfers between accounts. The platform is designed for ease of use, with all functions available in one place. Whether you’re paying bills, transferring money, or checking your balance, Coyyn.com offers everything you need for efficient financial management.

Why Coyyn.com Digital Banking is the Future of Finance

As we move into a more digital world, Coyyn.com digital banking stands out as a leader in modern finance. With traditional banking services shifting online, Coyyn.com provides all the convenience of managing your money without needing to visit a branch. The ease of transferring funds, setting up recurring bill payments, and using mobile check deposits shows how digital banking has evolved. Additionally, Coyyn.com’s security features like two-factor authentication and encryption ensure that your information stays safe. As more people move away from physical banks, services like Coyyn.com make it easier for individuals to handle their finances while keeping up with today’s fast-paced digital lifestyle.

How to Safely Manage Your Finances with Coyyn.com Digital Banking

Managing your finances with Coyyn.com digital banking is safe and secure when you follow best practices. First, always create strong passwords and change them regularly. Using a combination of uppercase, lowercase, numbers, and symbols makes your password hard to guess. Another key step is enabling two-factor authentication (2FA), which adds an extra layer of security to your account. Also, regularly monitor your account activity for any suspicious transactions. If you notice anything unusual, immediately contact Coyyn.com’s customer support. It’s also wise to update the Coyyn.com mobile app to the latest version to protect your data with the most recent security updates.

Understanding Mobile Check Deposit with Coyyn.com Digital Banking

Mobile check deposit is one of the most convenient features of Coyyn.com digital banking. With just a few simple steps, you can deposit checks from the comfort of your home or while on the go. All you need to do is open the Coyyn.com app, take a photo of the front and back of your check, and submit it for processing. The app will confirm that the deposit was successful, and you’ll receive a notification once the funds are available in your account. This feature saves time, especially for people who don’t have the time or ability to go to the bank in person.

Instant Transfers with Coyyn.com Digital Banking: How It Works

One of the best features of Coyyn.com digital banking is the ability to transfer money instantly between accounts. Whether you’re moving funds between your own accounts or sending money to someone else, Coyyn.com makes it quick and easy. The transfer process is simple: just enter the amount you want to send, select the recipient, and confirm the transaction. Coyyn.com ensures that the transfer is done securely with encryption and other safety measures. Instant transfers are especially helpful when you need to quickly pay for something or share money with friends or family, making it a highly efficient feature.

Top Tips for Safe Online Banking with Coyyn.com Digital Banking

To ensure your safety while using Coyyn.com digital banking, it’s important to follow key security tips. Always use a secure internet connection, such as Wi-Fi with a password or a private mobile data network, when accessing your account. Avoid public Wi-Fi networks, as they can expose your data to hackers. Another tip is to regularly monitor your bank statements for any suspicious activity. If you receive any emails or texts that seem unusual or suspicious, do not click on links or share personal details. Finally, update your device’s security settings, including antivirus software and automatic app updates, to protect your information from potential threats.

Maximizing Your Coyyn.com Digital Banking Experience

To get the most out of Coyyn.com digital banking, explore all the features it has to offer. Set up bill payments to ensure that your bills are always paid on time, and consider setting up automatic transfers to save money regularly. Additionally, linking your other accounts to Coyyn.com allows for seamless management of all your finances in one place. Take advantage of the mobile check deposit feature for quick and easy check deposits. You can also set up notifications so you never miss a payment or transfer. By fully utilizing the features of Coyyn.com, you can take control of your finances and enjoy a smooth banking experience.

Linking Your Cards and Accounts to Coyyn.com Digital Banking

Linking your cards and other accounts to Coyyn.com digital banking is essential for easy management of your finances. By connecting your credit and debit cards, you can easily make payments or transfer money between your accounts. To link an account, simply enter the required information, such as your account number and routing details, into the Coyyn.com platform. Verification is usually completed within a few minutes, and once done, you can start using the linked accounts for payments, transfers, and more. Whether you’re linking accounts from the same bank or different financial institutions, Coyyn.com makes it a seamless process.

The Benefits of Using Coyyn.com Digital Banking for Bill Payments

Paying bills through Coyyn.com digital banking has many advantages. One of the biggest benefits is convenience—no more writing checks or making trips to the bank. With Coyyn.com, you can set up both one-time and recurring bill payments directly from your account. This ensures that your bills are always paid on time, helping you avoid late fees. Additionally, Coyyn.com offers a clear overview of your payments, so you can easily track your spending and manage your budget. The platform also supports multiple billers, allowing you to pay all your utility bills, loans, and credit card payments in one place.

Conclusion

Coyyn.com digital banking offers an easy and safe way to manage your money. With features like mobile check deposit, instant transfers, and online bill pay, you can take control of your finances from anywhere. Setting up your account is quick, and you can use the app to track everything on your phone. Digital banking makes life simpler, and Coyyn.com is a great choice for anyone looking for a convenient way to handle their money.

If you’re ready to embrace the future of banking, Coyyn.com makes it easy. With its focus on security, quick transfers, and useful tools, it’s a top option for managing your money online. Whether you’re new to digital banking or looking to switch to a better service, Coyyn.com provides everything you need for a smooth and safe banking experience.

FAQs

Q: How do I create an account on Coyyn.com digital banking?

A: To create an account, visit the Coyyn.com website, fill out the registration form with your personal details, and verify your identity. Then, download the mobile app to start using your account.

Q: Is Coyyn.com digital banking secure?

A: Yes, Coyyn.com uses strong security measures like encryption and two-factor authentication to protect your personal information and transactions.

Q: Can I deposit checks using Coyyn.com digital banking?

A: Yes, with Coyyn.com, you can easily deposit checks by taking a photo of them using the mobile app. It’s fast and secure.

Q: Are there fees for transferring money with Coyyn.com?

A: No, Coyyn.com offers free transfers between accounts and quick payments, making it an affordable option for managing your money.

Q: Can I pay my bills through Coyyn.com digital banking?

A: Yes, Coyyn.com allows you to set up one-time and recurring bill payments through their platform, making it easy to keep track of your expenses.